Financial Services

Markets move fast.

So should your data.

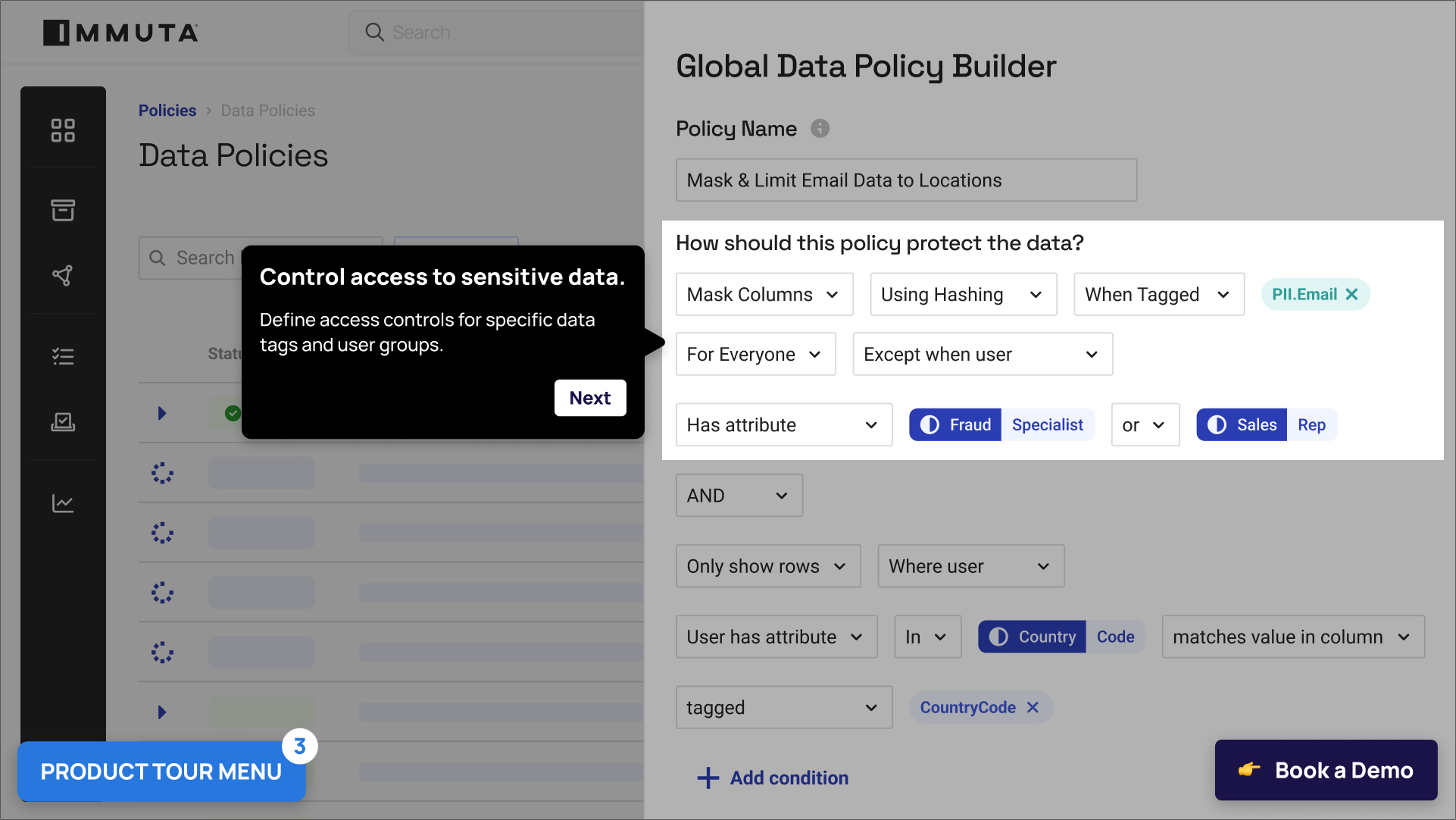

Get the right data — and only the right data — to reps and analysts when they need it most: now. With automated access controls and policies applied across multiple data platforms, you can personalize customer experiences, address fraud, collaborate with creditors and auditors, and trade faster, all while reducing risk and staying compliant.