The world of financial services never sleeps — and in this always-on industry, delays, mistakes, or indecision can literally cost millions. But speed can’t come at the expense of compliance, which puts data teams in a unique and complex position. Do you grant access to data at the speed of markets, or lock it down until you can verify each and every request?

As financial institutions strive to meet customer expectations, navigate a matrix of regulatory requirements, and drive innovation, the security and governance of their data is paramount. In this blog post, we’ll explain how Immuta’s integration with the Snowflake Financial Services Data Cloud helps you unlock secure, scalable financial data analytics and operations that drive results.

What Is the Snowflake Financial Services Data Cloud?

The Snowflake Financial Services Data Cloud offers a secure and scalable data cloud platform where you can seamlessly ingest, store, and analyze vast amounts of financial data for rapid innovation. Users benefit from Snowflake’s core platform capabilities, industry-tailored solution accelerators, more than 1,000 Snowflake Marketplace data sets, and data sharing features that enable collaboration with other Snowflake customers on financial initiatives.

Financial Services Data Security Challenges

Data’s role in financial services analytics is a no-brainer, but what about its security? Beyond the hustle and bustle of trading floors and the roughly 1.3 million credit card transactions that occur per minute, it’s a sector governed by stringent regulations, including:

- General Data Protection Regulation (GDPR)

- Payment Card Industry Data Security Standard (PCI DSS)

- Sarbanes-Oxley Act (SOX)

- Gramm-Leach-Bliley Act (GLBA)

- Payment Services Directive (PSD2)

Protecting sensitive financial data isn’t merely a best practice; it’s a legal obligation. But at the same time, markets are always moving. This is where the data security challenge truly emerges.

Balancing the need for fast data access with the imperative to safeguard sensitive information can be a major headache. On one hand, your analysts and BI users need data simply to do their jobs, and on the other, your security and governance officers require verification that your controls don’t violate regulatory compliance standards. Waiting for approval can be tedious and lead to stale data, which in addition to being useless for real-time analytics, is a drain on resources if done manually.

How Immuta Protects Customers’ Data in the Snowflake Financial Services Data Cloud

With more than two dozen customers in the financial sector, we understand the unique needs and challenges you face. Our partnership with Snowflake is built to improve security posture within Snowflake’s Financial Services Data Cloud by addressing obstacles of data security in financial services head on.

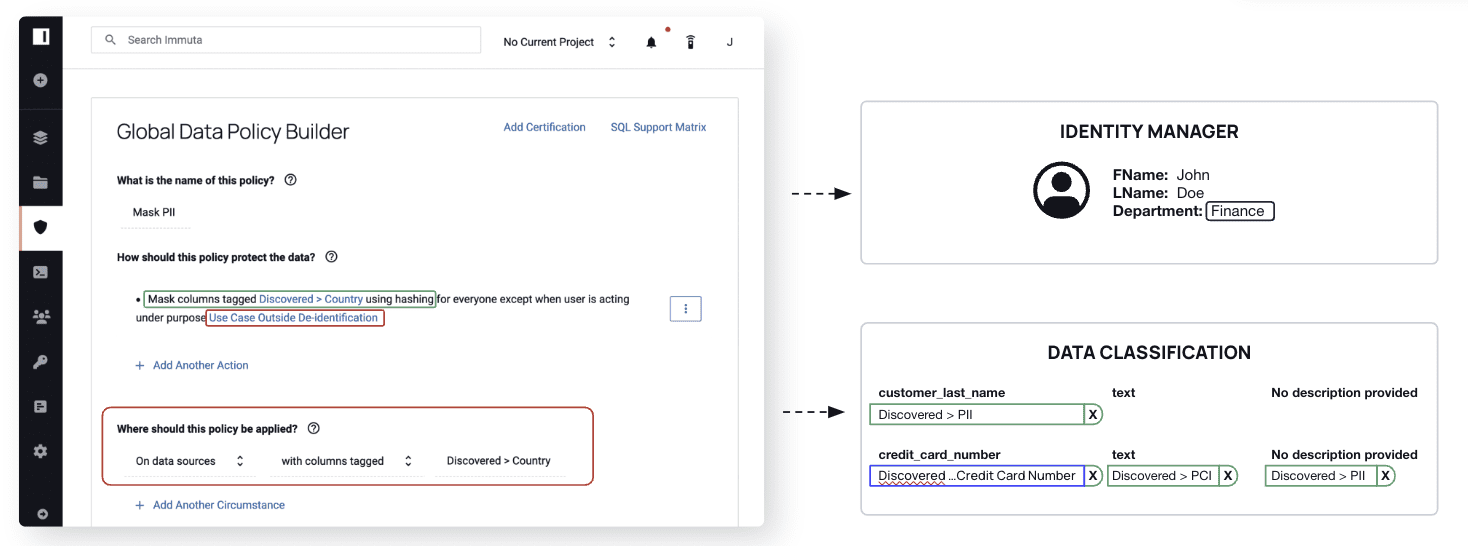

But how does it all come together? Immuta manages policy administration for Snowflake and pushes user attributes, including purpose, into Snowflake to drive dynamic and scalable enforcement. By administering native Snowflake controls, Immuta maintains a transparent data access layer so policies are applied directly on top of Snowflake tables. Since policy management is done in Immuta and not based on roles in Snowflake, enforcement is highly scalable and requires minimal overhead.

These policies start with Immuta’s sensitive data discovery and classification, which automatically scans data sources for sensitive information, like credit card or bank account numbers, and tags it for easy policy creation and enforcement.

Governance and compliance teams can approve policies and audit how they’re being enforced with Immuta Detect, which monitors data use and proactively identifies anomalies and potential threats. If you’re leveraging the Snowflake Financial Services Data Cloud, this gives you actionable insights that can help avoid becoming a headline and losing customers’ trust.

Putting the Snowflake Financial Services Data Cloud to Work

You don’t need us to tell you there are countless ways data is used in the financial services industry. But as customers seek highly personalized experiences, regulations continue to evolve, and cybercrime increases, there are six key ways to leverage Immuta’s integration with the Snowflake Financial Services Data Cloud:

- Perform quantitative research: Use financial data to assess market trends, analyze investment opportunities, and train predictive models.

- Deliver customer 360s: Build relationships, personalize services, and provide a top-notch customer experience using data about their preferences and behaviors.

- Manage claims more efficiently: Real-time access to claims data streamlines operations, reduces costs, and makes you better able to provide your policyholders with fast, fair settlements.

- Prove regulatory compliance: Generate data audit trails and reports on demand to simplify proof of compliance processes, maintain your reputation, and do right by your customers.

- Underwrite effective insurance policies: Analyze data to accurately assess risks, determine fair premiums, and drive profitability while providing your customers with the coverage they need.

- Prevent fraud: Detect and avoid the risk of fraud by aggregating data from across the business so you can minimize the risk of losing trust, reputation, and money.

To see how it plays out in practice, consider a multinational bank offering investment, commercial banking, and wealth and asset management services to millions of public and private customers. The bank needed to streamline data use and manage access across all global lines of business. By integrating Immuta with Snowflake, they were able to automate previously manual processes, accelerating self-service without compromising security. As a result, the bank simplified and scaled data security by centralizing controls in a single platform, enabled self-service data access to 5,000 users in just six months, and automated 95% of data access control requests, which saved more than $50M in resources.

As the financial services industry continues to evolve and new paradigms like data mesh emerge, having a seamless solution for managing data security across Snowflake and any other platform in your tech stack will keep you on the leading edge of the competition. To read more about how our partnership is making that easy and compliant, check out our eBook, Powering Your Data Mesh with Snowflake & Immuta.

Get started with Immuta & Snowflake

Schedule a meeting with us.